Investing in Ukraine's Defense Industry

- Home

- /

- Investing in Ukraine’s...

A Strategic Guide for Global Investors

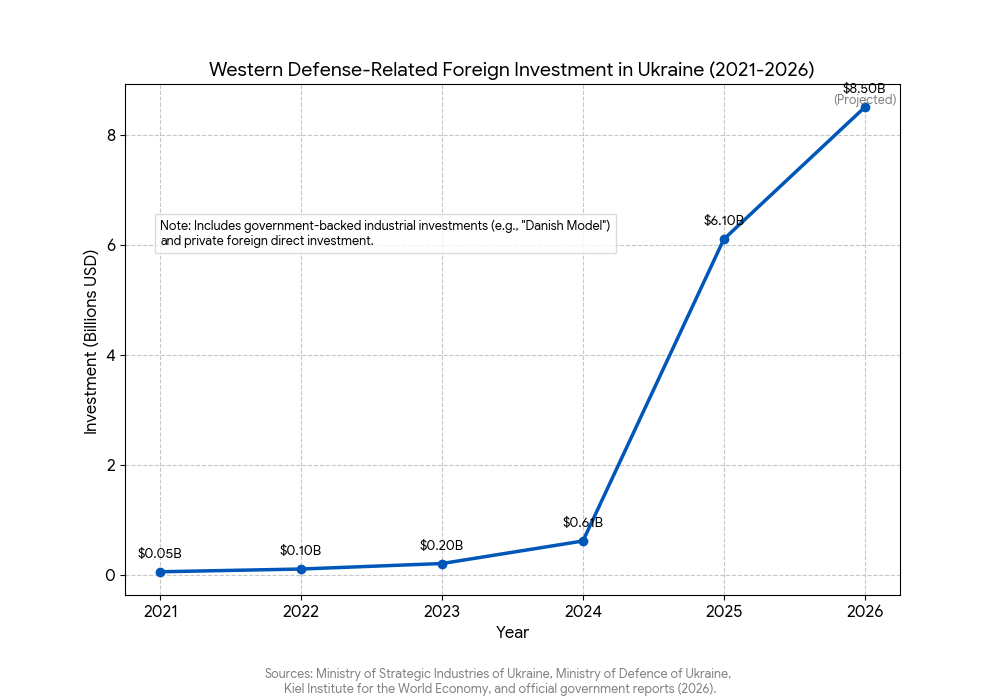

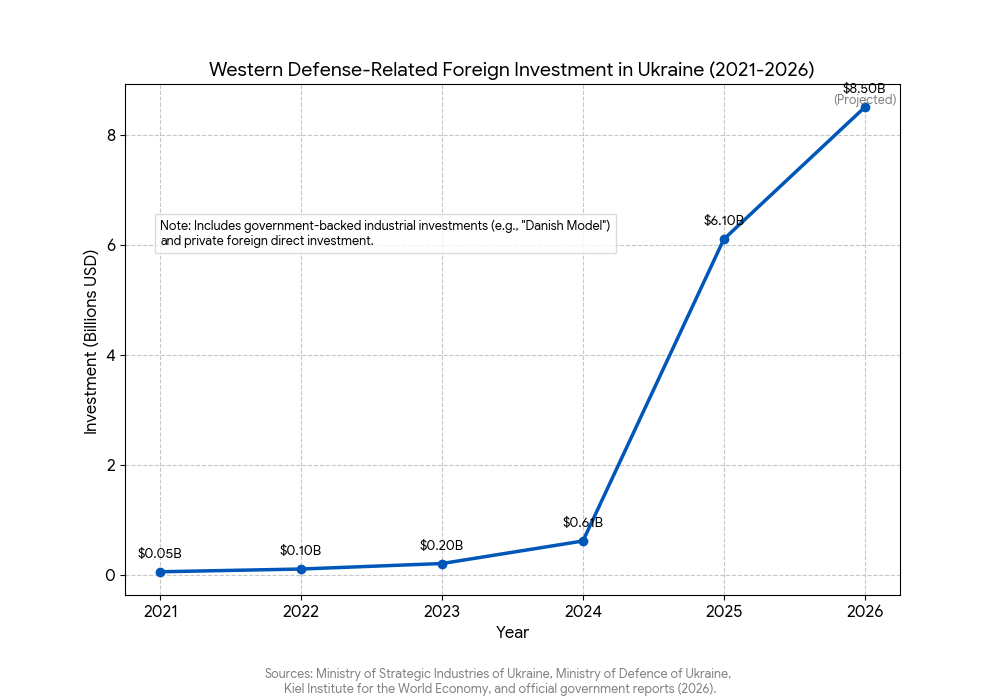

The war in Ukraine has fundamentally reshaped the global defense landscape. Once considered a niche market, Ukrainian defense technology has proven itself on the battlefield, driving a surge in investment interest across Europe and beyond. As of late 2025, the sector is transitioning from rapid, grass-roots innovation to scalable, industrial-grade production.

Since the 2022 full-scale invasion, Ukraine has become the world’s premier “battlefield laboratory.” The urgency of the conflict has compressed decade-long development cycles into weeks. For investors, this represents a unique opportunity to back battle-hardened technologies that are defining the future of global security. This guide provides investors, VCs, and strategic partners with a roadmap for navigating Ukraine’s defense ecosystem. It details the “Why” (opportunities), the “But” (challenges), and the “How” (concrete steps to invest).

This guide outlines the pathways, regulatory frameworks, and strategic entry points for investing in Ukrainian DefenseTech.

The Landscape: Why Invest Now?

According to the State of Defence Tech 2025 (Dealroom Report) and The Rise of European Defence Tech (PitchBook) reports, European defense tech has entered a new era of growth. Ukraine is at the epicenter of this shift.

Key Opportunities

- Real-World R&D: Ukrainian startups operate in the most rigorous testing environment on earth. Technologies are iterated daily based on combat feedback, drastically reducing the time-to-market for proven solutions.

- Cost-Effectiveness: Ukrainian defense solutions often offer a “cost-to-effect” ratio superior to Western legacy systems (e.g., FPV drones vs. traditional artillery).

- Breaking the “Lethal” Taboo: As noted by TechCrunch, European VCs are increasingly moving beyond “dual-use” (civilian and military) to invest in “pure defense” technologies, reflecting broader acceptance of the urgent need for innovation and growth in this space.

- Regulatory Moats: While red tape is often cited as a burden, PitchBook notes that for established defense startups, complex regulations act as a competitive moat against new, unproven entrants. Quick action now can turn this into advantage versus later entrants.

- Government Support: The Ukrainian government, via platforms like Brave1, has streamlined the approval process for defense tech adoption, creating a fast track from prototype to procurement and the most fertile ground in the world for diverse defense innovation.

The Typical Entry Point: Brave1

A useful first resource for any potential investor into Ukraine is Brave1, the government-led defense tech cluster. It serves as the unified portal for startups, investors, and the military.

- What they do: Review technologies, provide R&D grants, and facilitate testing on the front lines.

- Investor benefit: Brave1 provides a “white list” of projects that have passed military evaluation, significantly de-risking the technical due diligence process.

- Action: Register as a partner via Brave1.gov.ua. Resources are provided after investor validation. Contact DTU to speed up this process.

Alternative Entry Point: Iron Tech Cluster

Ukraine’s tech and defense landscape is organized into several key clusters that act as entry points for international investors. These associations and networks are highly decentralized, with active “clusters” (regional associations of IT companies) operating in almost every major city. These organizations have shifted from general tech advocacy to focused support for the defense sector (“DefTech” or “MilTech”) since 2022.

The Iron Tech Cluster (often referred to simply as IRON) is one of the most critical organizations for defense sector investment in Ukraine. The organization started in Lviv but has since spread across Ukraine.

The war has shifted the specialization of these hubs: western cities (Lviv, Ivano-Frankivsk, Zakarpattia) have become relative “safe havens” and manufacturing centers, while eastern and central cities (Kyiv, Kharkiv, Dnipro) act as operational backbones and R&D centers despite the risk.

Major Tech Cluster Cities

1. Lviv (Western Hub)

- Organization: Lviv IT Cluster (also operates the Iron Tech Cluster) itcluster.lviv.ua ironcluster.org

- Focus: This is currently the most robust ecosystem due to its relative safety from the frontlines. It has evolved from a pure software outsourcing hub into a “hardware-first” center.

- Specialization: Military-tech manufacturing (drones, robotics), cybersecurity, and physical product development.

- Key Asset: The “Lviv Tech City” innovation district.

2. Kyiv (Capital)

- Organization: Kyiv IT Cluster kyivitcluster.ua

- Focus: The political and economic center of the industry. Kyiv hosts the headquarters of most national “DefTech” (defense tech) organizations like Brave1.

- Specialization: Government-govtech (Diia app development), large-scale enterprise software, and AI R&D.

- Key Asset: Access to national decision-makers and the largest talent pool in the country.

3. Kharkiv (Iron Outpost)

- Organization: Kharkiv IT Cluster it-kharkiv.com

- Focus: Located just 40km from the Russian border, this cluster is famous for its “Iron” resilience. Before the war, it was the education capital of Ukraine with the highest concentration of technical universities.

- Specialization: Engineering, complex math-heavy coding, and tech education. Despite the shelling, the cluster remains active, focusing on keeping the digital infrastructure running.

- Key Asset: A massive network of technical universities that feeds the industry.

4. Dnipro (Industrial Heart)

- Organization: IT Dnipro Community itdni.pro

- Focus: A major industrial city that bridges the gap between old-school heavy industry and new-school tech.

- Specialization: Space tech (legacy of Yuzhmash rocket factory), sophisticated engineering, and outsourcing.

- Key Asset: Strong engineering culture derived from its aerospace history.

5. Ivano-Frankivsk (Creative Hub)

- Organization: Ivano-Frankivsk IT Cluster it-cluster.if.ua

- Focus: A smaller, quieter city in the west that attracts “digital nomads” and creative tech workers.

- Specialization: Design, web development, and creative industries.

- Specialization: Design, web development, and creative industries.

6. Zakarpattia / Uzhhorod (Safe Haven)

- Organization: Zakarpattia IT Cluster itct.com.ua

- Focus: Located right on the border with Slovakia and Hungary, this region exploded in popularity after the 2022 invasion as companies relocated staff here for maximum safety.

- Specialization: Relocation services, remote work hubs, and serving as a gateway to the EU markets.

- Specialization: Relocation services, remote work hubs, and serving as a gateway to the EU markets.

7. Odesa (Maritime Hub)

- Organization: Odesa IT Family it-family.od.ua

- Focus: Historically a port city, its tech sector is outward-facing and international.

- Specialization: Logistics software, marine tech, and ecommerce.

- Specialization: Logistics software, marine tech, and ecommerce.

How These Associations Help International Investors

Investing in a war zone involves high risk and difficulty in verifying assets (“due diligence”). These associations mitigate those risks in three specific ways:

A. Due Diligence & Validation (The “Combat Proven” Stamp)

Investors often struggle to know if a drone company’s product actually works.

- IRON Cluster validates the manufacturing capacity of hardware teams, ensuring they aren’t just R&D labs but have the supply chains to fulfill orders.

B. Access to “Datarooms” and Testing Grounds

- Tech Access: Allows defense companies to train their algorithms on real combat data in a secure environment. Investors gain access to companies that have a “data moat” no other competitors in the world possess.

- Physical Access: The IRON Cluster facilitates access to testing ranges where hardware is put through stress tests, allowing investors to see performance results before committing capital.

C. Navigation of Compliance & Logistics

- Regulatory Shielding: Defense investment in Ukraine is subject to strict export controls and secrecy laws. These clusters guide foreign investors through the “Diia City” legal framework, which offers tax incentives and clearer IP protection for foreign-backed tech companies.

- Local Partner Matching: They act as matchmakers, pairing international venture capital with local engineering teams that may not speak fluent English or understand Western investment term sheets.

Investment Pathways

There is no “one size fits all” approach. Depending on your risk profile, investment experience, familiarity with Ukraine and capital, you can choose one of three primary paths.

Path A: Invest Through Specialized Funds (Lower Risk)

For Limited Partners (LPs) or investors seeking exposure without managing individual deals.

- Identify Active Funds: Look for funds with a specific thesis on Eastern European or Deep Tech defense. Refer to the Most Active VC Funds in European Defence Tech.

- Engage with NATO Innovation Fund (NIF): The NIF is a key player investing in venture capital funds and startups across the alliance, including Ukraine.

- European Investment Fund (EIF): Monitor the EIF for guarantees and investments they are funneling into Ukrainian VC funds.

- For Ukraine-specialized funds, consider:

- Green Flag Ventures: American-led Ukraine-located dual-use and defense fund

- MITS Capital: American-led Ukraine-located fund creating primes

- D3: Ukraine-located fund

- Double Tap Investments: Finnish-Ukrainian fund with several investments in Ukrainian defense companies

Path B: Direct Investment (Higher Risk, Higher Control)

For VCs and Angel investors looking to deploy capital directly into startups.

- Access the Pipeline:

- Brave1: This is the Ukrainian government’s central defense tech cluster. Register on their platform to access a database of vetted startups and procurement needs.

- Iron Cluster: Originally Lviv-centered industry consortium, is growing into a smaller but in some ways parallel Brave1. Similar to a Ukrainian version of the American Small Business Association. See above for details.

- Defence Builder: An industry connector that helps match investors with defense manufacturers.

2.Due Diligence (The “Ukraine Protocol”):

- Verify IP ownership and ensure it is secured in jurisdictions outside of Ukraine if necessary.

- Assess the team’s “continuity plan” (e.g., do they have backup operations in Western Ukraine or neighboring countries? Are their products NATO certified? Do they have western partners?).

- Check for existing government contracts or “State Defense Orders” to validate product-market fit. What is the end-user feedback on their products. Contracts don’t necessarily equal quality. This is an area where DTU can provide valuable counsel. Contact us to discuss more: Link to DTU Investor Inquiry Form

- Production risk – How susceptible to Russian attack is the firm’s factory, offices and suppliers? Can you physically visit to verify operations? These hard questions are necessary in a country at war.

3. Structure the Deal: For fast closing, strongly consider SAFE notes or KISS agreements, adapted for Ukrainian jurisdiction. Many Ukrainian startups s take investment via entities set up in Delaware, Estonia, Cyprus, the Netherlands, etc to ease political and legal risk. Contact DTU for a list of experienced Ukrainian attorneys.

Path C: Strategic Partnerships & Grants (Non-Dilutive)

For corporations and R&D entities looking to innovate without equity exchange.

- European Defence Fund (EDF): Participate in EDF calls for proposals. These are highly competitive but offer substantial funding for collaborative R&D involving Ukrainian entities. See the EDF Official Webpage.

- Horizon Europe: Ukraine is associated with Horizon Europe. Monitor Horizon Europe Ukraine for grant opportunities in dual-use technologies (AI, robotics, space).

- Joint Ventures (JVs): Establish a JV with a Ukrainian manufacturer. This allows for technology transfer while providing the Ukrainian partner with capital and access to Western supply chains.

Key High-Growth Sectors

Based on current battlefield requirements and market data (Dealroom 2025), the following sectors offer the highest ROI and strategic value:

- Autonomous Systems: Air, sea, and land drones (UAVs, USVs, UGVs).

- Electronic Warfare (EW): Signal jamming and drone-countermeasures.

- Battlefield AI: Automated target recognition and decentralized command-and-control systems (e.g., Helsing-style integrations).

- De-mining Tech: Ukraine is currently the most mined country on earth; the long-term market for recovery tech is massive.

Navigating Challenges & Risks

Investing in a country at war requires a sophisticated risk-mitigation strategy:

- Physical Security: Many startups utilize decentralized manufacturing or underground facilities to mitigate missile threats.

- Regulatory “Moats”: While defense red tape is often seen as a burden, it acts as a moat. Companies that achieve NATO-standard certification or Ukrainian Ministry of Defense (MoD) “admission to exploitation” gain a massive competitive advantage.

- Export Controls: Understand the State Service of Export Control (SSEC) regulations. Investing in companies with a “dual-use” classification often simplifies international scaling.

- Strategic allies and experts – Savvy western firms retain experts with practical knowledge of Ukrainian customs, laws and risks. Contact DTU for a list of Ukrainian attorneys, compliance firms, accountants and other essential resources.

Step-by-Step Action Plan

Review the Brave1 Investment Guide: Contact Brave1 or DTU for the Full Investment Guide for detailed legal frameworks.

Identify Your Vehicle: Decide between direct investment, a VC fund, or a JV.

Due Diligence: Leverage DTU and Brave1 to verify the “combat-proven” status of the technology.

Legal Structuring: Many investors utilize “Luxembourg/Delaware-Ukraine” structures to protect IP and capital while maintaining operations in Ukraine.

Essential Resources & Reading

To deepen your understanding before deploying capital, we recommend the following resources:

Market Intelligence

- Ukrainian Defense Manufacturers at Brave1 Defense Tech Valley 2025 Conference (Defense Tech for Ukraine)

- The West Must Finance Freedom (Defense Tech for Ukraine)

- Most active VC funds investing in European defence tech startups (Vestbee)

- As war rages in Ukraine, investment in European defense and dual-use tech skyrockets (TechCrunch)

- European VC breaks taboo by investing in pure defense tech from Ukraine’s war zones (TechCrunch)

- Defense AI startup Helsing breaks the record for European AI, raising a $223M Series B (TechCrunch)

- More funding for defense tech? (TechCrunch)

- State of Defence Tech 2025 (Dealroom Report)

- 2025 Vertical Snapshot: Defense Tech (PitchBook Report)

- The Iron Bubble: Why defense tech might not be overhyped (PitchBook)

- Q4 2025 Defense Tech VC First Look (PitchBook Report)

- For defense tech startups, red tape is a burden—and also a moat (PitchBook)

- Europe’s defense-tech startups launch into new era of growth (PitchBook)

- Ukrainian Defense Startups Raise Over $105M in 2025 (Kyiv Post)

- Why Global Investors Are Pouring Millions Into Ukraine’s Combat-Tested Defense Tech (United 24 Media)

- $100M+ Boost: Global Investors Back Ukraine’s Defense Tech Breakthroughs: Results of Defense Tech Valley 2025 (digitalstate.gov.ua)

- Navigating Ukraine’s Defense Tech Market PDF Report (EY)

- Ecosystem Connectors

- Brave1 – The Gateway to Ukrainian Defense Tech

- Defence Builder – Industry Hub

- NATO Innovation Fund (NIF) – €1 billion VC fund investing in deep tech and dual-use startups.

- European Investment Fund (EIF) – The EU’s specialist provider of risk finance for small and medium-sized enterprises (SMEs)..

- Defense Tech for Ukraine (DTU) – We are a western defense tech incubator and small VC that can provide industry connections, insights and target opportunities

Conclusion

Investing in Ukraine’s defense sector is not merely a financial opportunity; it is a strategic contribution to global security. While the risks are real, the returns—both financial and geopolitical—are significant. By leveraging the government frameworks of Brave1 and the EDF, and partnering with experienced funds, investors can successfully navigate this high-growth frontier.

Contact Defense Tech for Ukraine (DTU) for industry connections, insights and target opportunities.

Contact DTU for access to the most active and combat-proven defence innovation environment in the world

Download this resource as a PDF, or contact DTU for a brief overview of investment risks and opportunities.

Contact DTU for access to the most active and combat-proven defence innovation environment in the world

Download this resource as a PDF, or contact DTU for a brief overview of investment risks and opportunities.